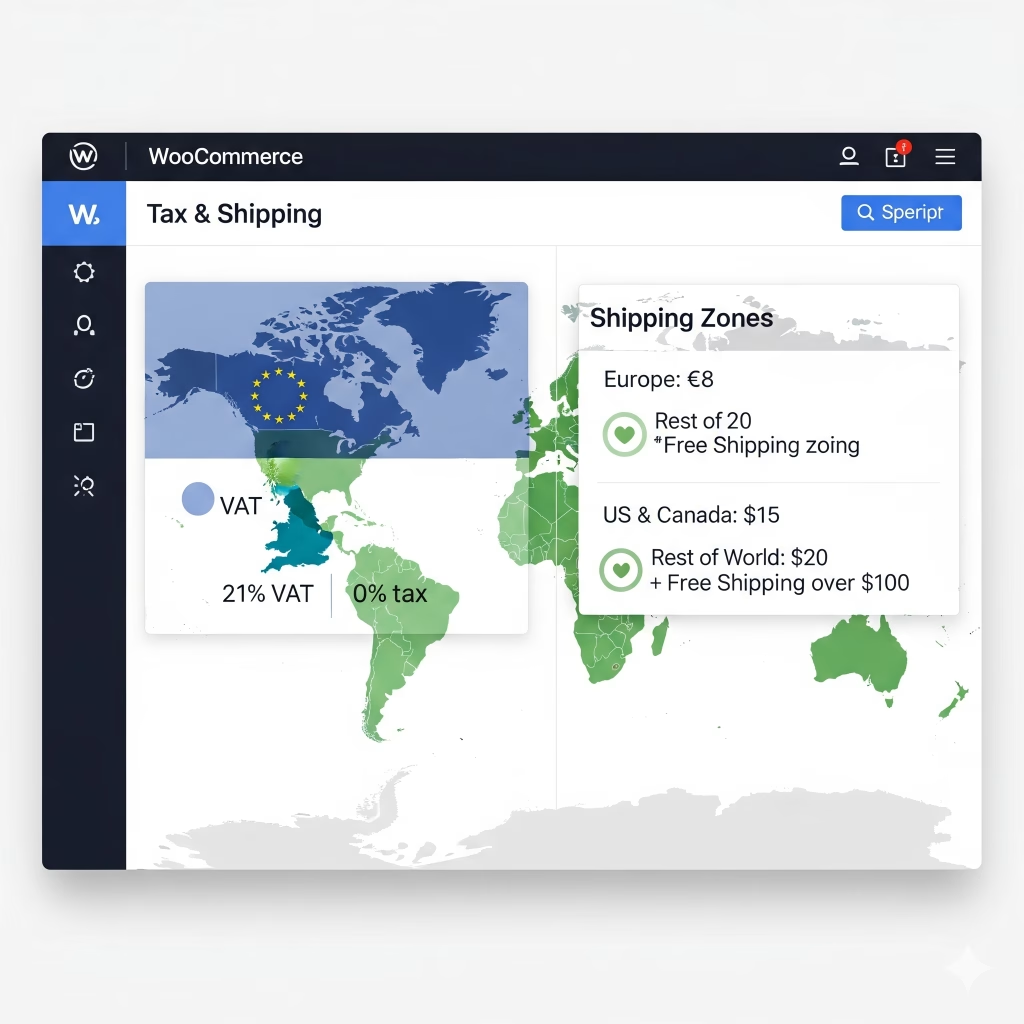

✍️ Example: EU VAT + Worldwide Shipping (WooCommerce)

- Tax zones:

- EU countries: 21% VAT

- Non-EU: 0% tax

- Shipping zones:

- Europe: Flat €8

- US & Canada: Flat $15

- Rest of World: $20 + optional free shipping over $100

✅ Tax Setup (Automated or Manual)

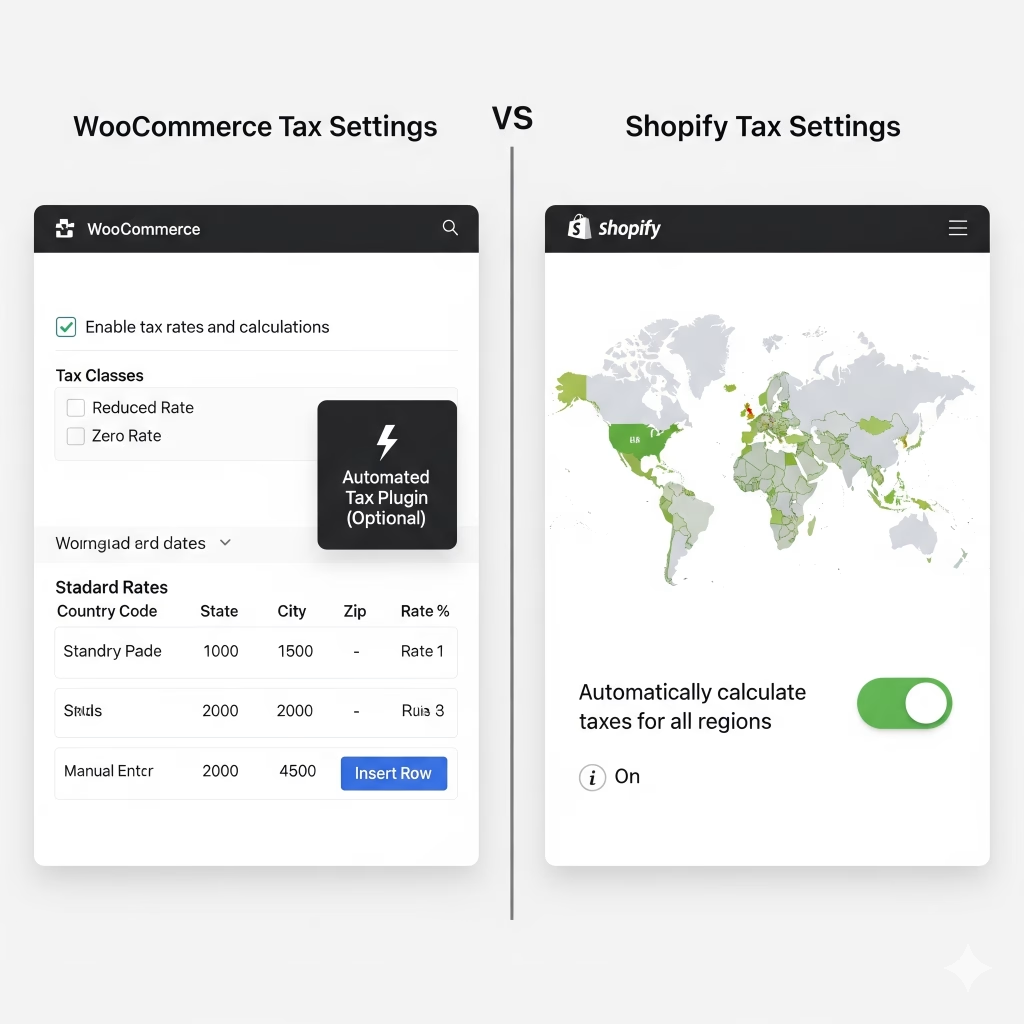

🔹 WooCommerce (WordPress)

- Go to WooCommerce > Settings > Tax

- Enable taxes and configure:

- Tax classes (e.g., standard, reduced, zero)

- Rates per country, state, ZIP

- Choose whether prices are inclusive or exclusive of tax

🧠 Optional Plugin:

- WooCommerce Tax (by Jetpack)

- Automatically calculates tax based on buyer location

- No need to manually update rates

🔹 Shopify

- Go to Settings > Taxes and duties

- Set up regions with local VAT or sales tax rules

- Shopify auto-updates most regional tax rates (e.g., EU, US)

🚚 Shipping Zone Setup

🔹 WooCommerce

- Go to WooCommerce > Settings > Shipping

- Add Shipping Zones by:

- Country or group of countries

- Specific ZIP/postal codes

- For each zone, add:

- Flat rate

- Free shipping

- Local pickup

- Weight-based or quantity-based pricing (with plugin)

🧰 Add-ons:

- Table Rate Shipping for advanced rules (distance, volume, etc.)

- Shipping classes to charge differently for product types

🔹 Shopify

- Go to Settings > Shipping and delivery

- Define shipping profiles and zones

- Assign different rates by country, region, or product

- Can offer live rates with carrier integrations (e.g., USPS, FedEx)

MORE LINKS:

E-commerce store

Sell digital products

Integrate payment gateways

Manage inventory

Manage bookings

Cart recovery

Shopify vs Woocommerce

Discount coupons

Store ownership

SET UP TAX AND SHIPPING ZONES

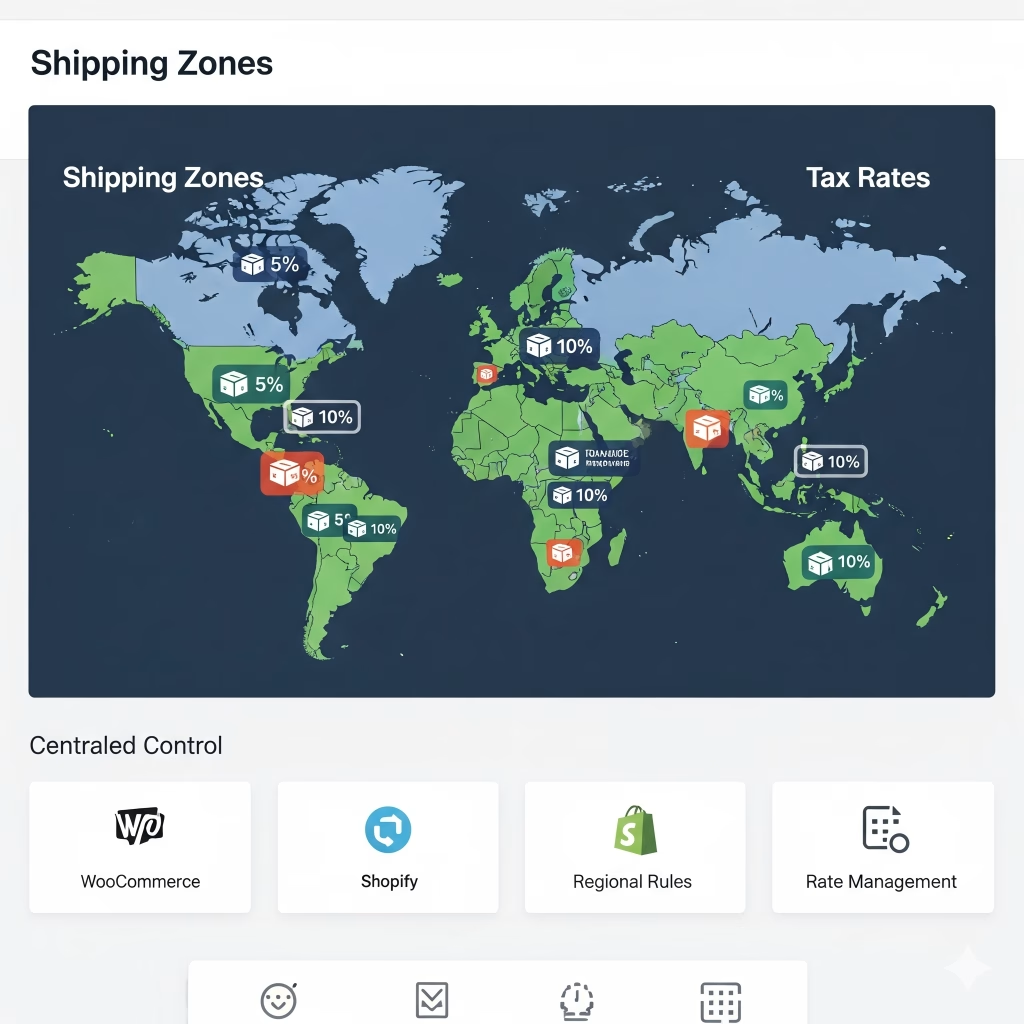

We can fully set you up with tax and shipping zones on your website, making sure your store handles regional rules and rates correctly. This setup is essential for any e-commerce business that ships physical goods or charges tax based on customer location. Platforms like WooCommerce (on WordPress) and Shopify offer built-in tools that make it easy to configure tax rates, shipping zones, and location-based pricing all from a centralized dashboard.

For taxes, we’ll help you define which regions require collection and apply the correct rules automatically. You can set up standard tax rates, reduced rates, or exemptions depending on your business needs. In WooCommerce, you can manage taxes manually or connect to services that keep rates updated. Shopify also provides automated tax calculations for many regions, helping you stay compliant without needing constant updates or manual tracking.

Shipping zones allow you to control how and where you deliver your products. You can create different zones for countries, regions, or postal codes, and assign shipping methods and rates to each one. This includes flat-rate shipping, free shipping over a certain amount, or real-time carrier rates from services like UPS, DHL, or local couriers. You can also set handling times, restrict shipping to certain areas, or apply custom rules based on product weight or order size.

By organizing your tax and shipping settings properly, you streamline the checkout process and eliminate confusion for your customers. Everything works automatically behind the scenes, calculating the correct fees and options based on where your customer is located.

With our help, your store will be professionally configured to support global or local selling, giving buyers a smooth and reliable shopping experience no matter where they are.